for PAN Card" width="1200" height="627" />

for PAN Card" width="1200" height="627" /> for PAN Card" width="1200" height="627" />

for PAN Card" width="1200" height="627" />

Table of Contents

The last date for linking Aadhaar with PAN is 30th June 2023. PAN will become inoperative from 1st July 2023 if it is not linked with Aadhaar.

Partnership firms are formed by two or more parties who agree to share the responsibilities and profits or losses incurred by a business. They agree to do so over an oral or written agreement called a partnership deed. Since a verbal agreement has no validity for tax purposes, most partnership firms have a written, legally-valid partnership deed in place before starting the business. The registration, working and regulation of Partnership firms fall under the purview of the Indian Partnership Act, 1932. However, to file taxes, the partnership firm must register with the IT Department and possess a valid PAN card. In this article, we will take a look at Documents Required for PAN Card and how the PAN card is useful for a partnership firm, and what firms can do to apply for one.

To be eligible to file Income Tax returns, partnership firms need to submit their partnership deed and PAN card to the IT department. Firms can apply for a PAN Card through application form 49A. However, before filing a PAN card application, a firm must complete certain formalities. Here’s a look at what a partnership firm registration needs to do before filing for a PAN card.

Here’s how you apply for a PAN Card online through the Income Tax Department’s website by providing Documents Required for PAN Card through online:

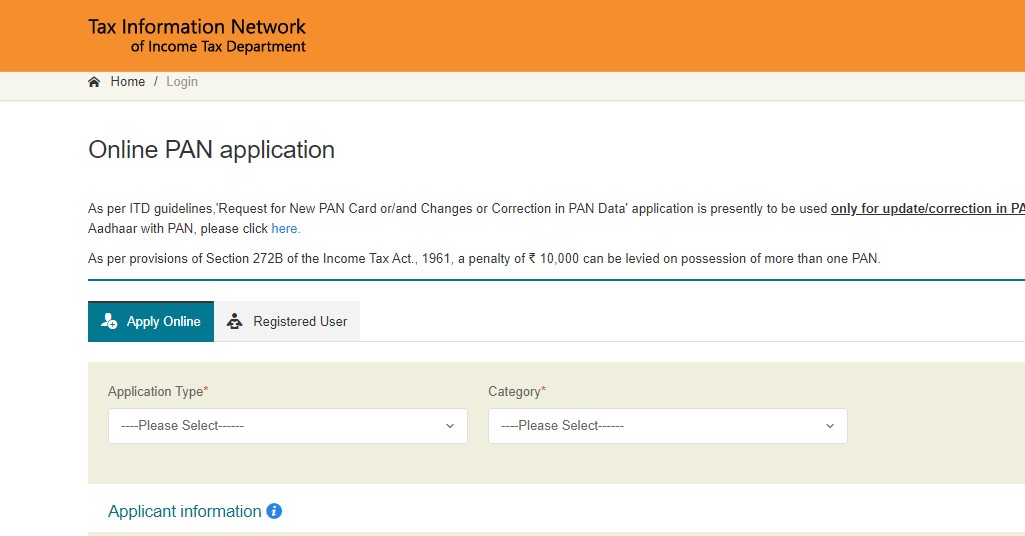

Step 1: Visit the official website of the NSDL via https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

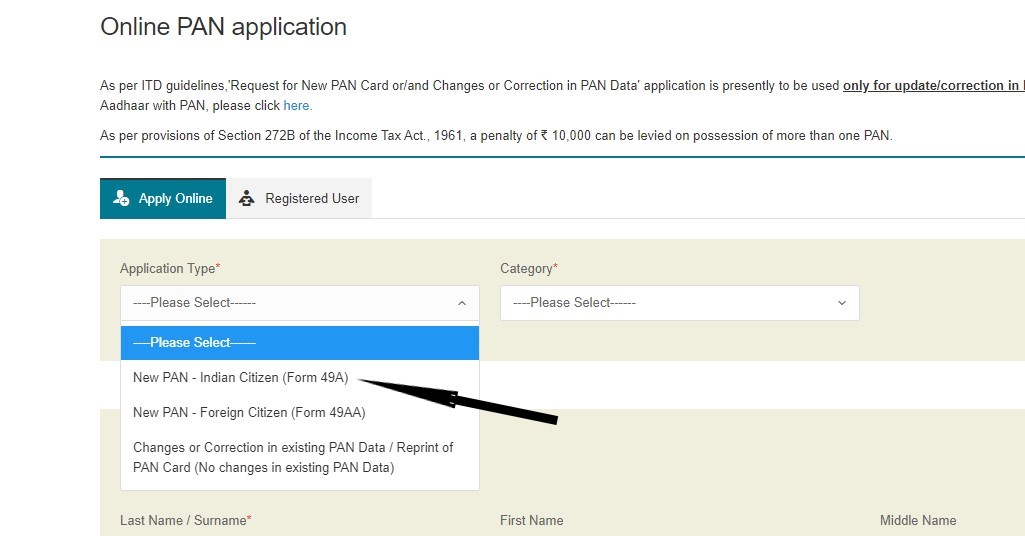

Step 2: From the home page, Select the application type from dropdown menu as New PAN for Indian Citizen )Form 49A) option.

Make sure you go through the instructions carefully before starting to fill the form.

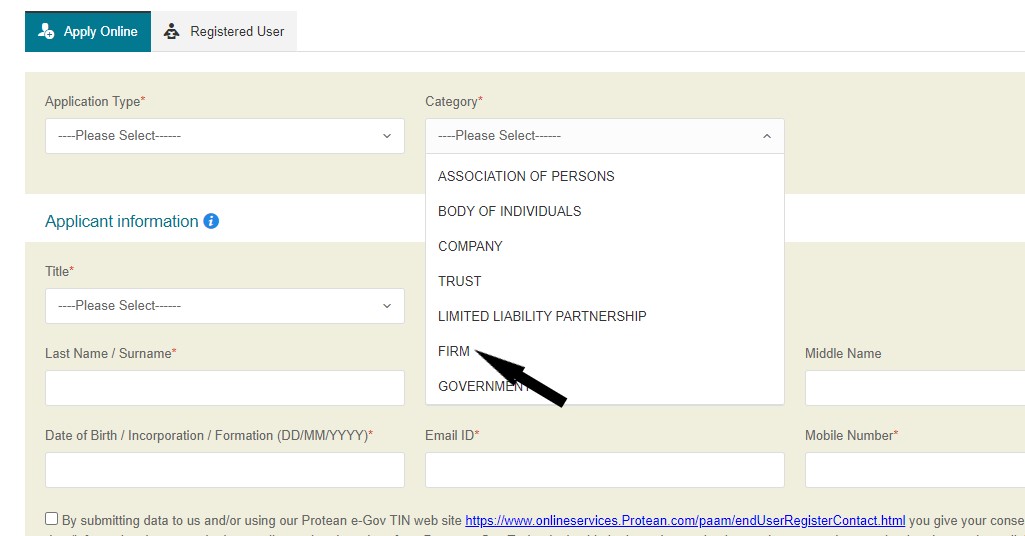

Step 3: Select Firm as your category and provide the other details requested

In case there is an error in the format, a response will be generated indicating the errors

Step 4: The applicant must then make the required changes and re-submit the form.

Step 5: Next, choose a mode of payment from DD, credit or debit card, net banking and cheque and complete the payment of INR 105

Step 6: Once the process is complete, take a print-out of the acknowledgement slip

Step 7: Fix a recent passport size photograph on the slip and attest it with a black pen

Step 8: Next, send this acknowledgement receipt to the Income Tax Department along with the other supporting Documents Required for PAN Card within fifteen days.

After verification of the Documents Required for PAN Card, the PAN card will reach the address provided in around fifteen days. To track your PAN Card online, you may use the acknowledgement number you receive after completing the registration.

Here’s a look at the details you need to fill on an application form for obtaining a PAN card as a partnership firm by submitting documents required for PAN card :

| Business Code | Types of Businesses |

| 01 | Medical Profession and Business |

| 02 | Engineering Business |

| 03 | Architecture |

| 04 | Chartered Accountancy |

| 05 | Interior Decoration |

| 06 | Technical Consultancy |

| 07 | Company Secretary |

| 08 | Legal Practitioner and Solicitors |

| 09 | Government Contractor |

| 10 | Insurance Agency |

| 11 | Films, TV and Entertainment |

| 12 | Information Technology |

| 13 | Builders and Developers |

| 14 | Brokers and members of the Stock Exchange |

| 15 | Performing Arts and Yatra |

| 16 | Ship, Aircraft, Hovercraft, and Helicopter Operators |

| 17 | Taxi, Lorry, Bus or Commercial Vehicle plying |

| 18 | Horse ownership or jockeying |

| 19 | Cinema Halls and Theatres |

| 20 | Others |