Track mileage reimbursements effortlessly with our free mileage reimbursement form. Available in PDF, Word, Excel, and Google formats. Get started by downloading, customizing, and printing yours today.

Employee mileage can be difficult to keep track of. And depending on which state your business is located in, logging mileage for reimbursement may be required.

To help you keep track of employee mileage, we’ve provided a simple mileage reimbursement form that you can download, print, and customize to your businesses needs. Be sure to check out the full article for tips and information about mileage reimbursement forms!

This printable mileage reimbursement form makes logging employees' work trips simple. Whether they are using their personal vehicle for occasional work trips or frequent ones, they can keep track of the date and time of their trips, trip descriptions, miles traveled, and more.

Download and print yours for free. Available in Word, Excel, Google Docs, and Google Sheets.

Track mileage automatically and streamline your payroll operations with Workyard’s GPS time tracking app designed for field workers. Workyard detects all driving trips, automatically calculates mileage for workers, and gives you transparency into the exact routes taken by each employee.

![]()

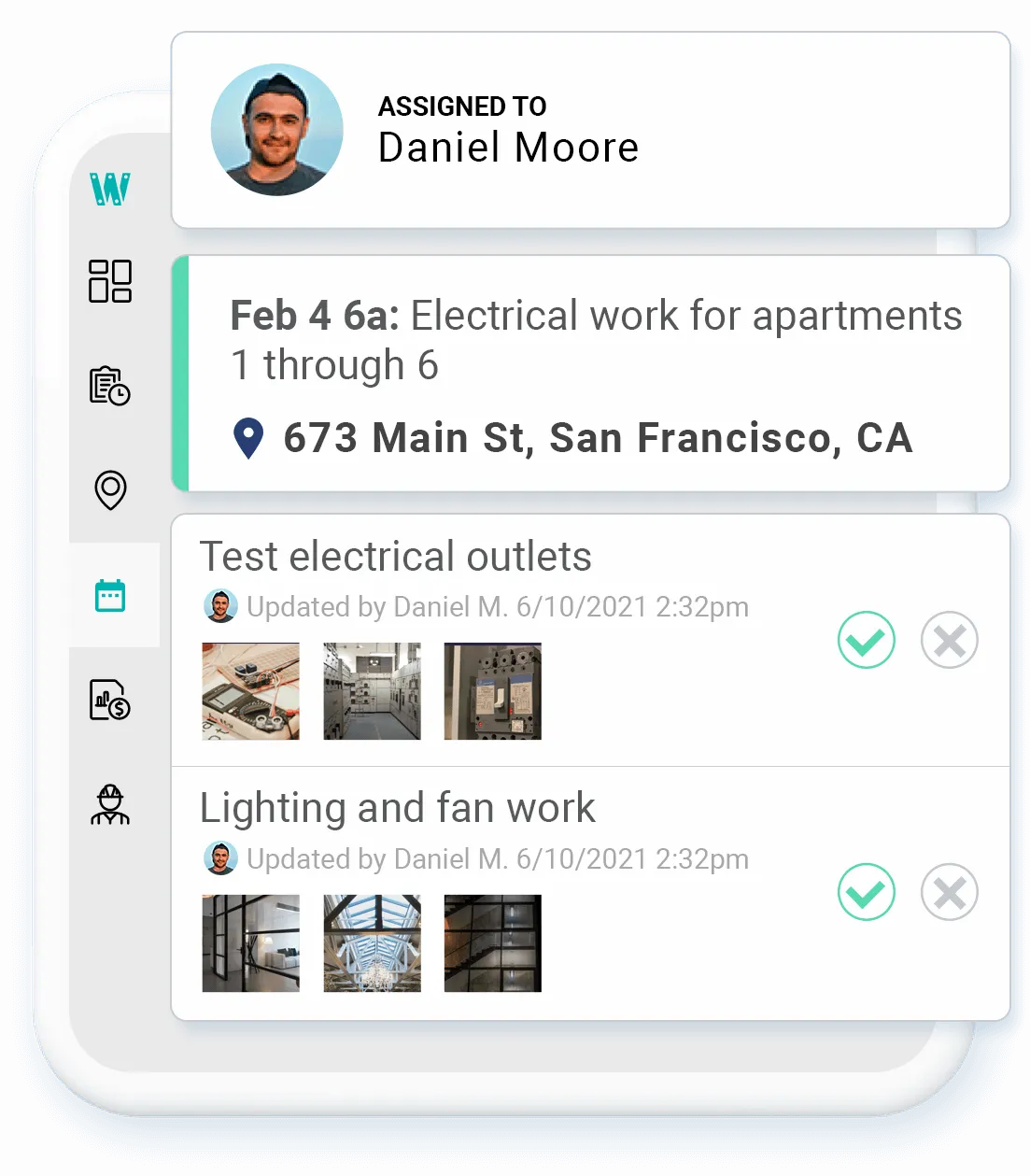

Eliminate excessive payroll expenses caused by inaccurate time cards. Workyard’s construction time sheet app provides employee arrival times, departure times, and precise addresses using the most accurate GPS technology in construction. To make auditing timesheets even easier, Workyard uses smart alerts to surface potential time card mistakes.

Schedule the right employee, at the right time, with a simple calendar based organizer. Organize daily and weekly schedules by employee and/or job. Communicate exactly what needs to be done with notes, checklists, and attachments that your employee's can access from our mobile app.

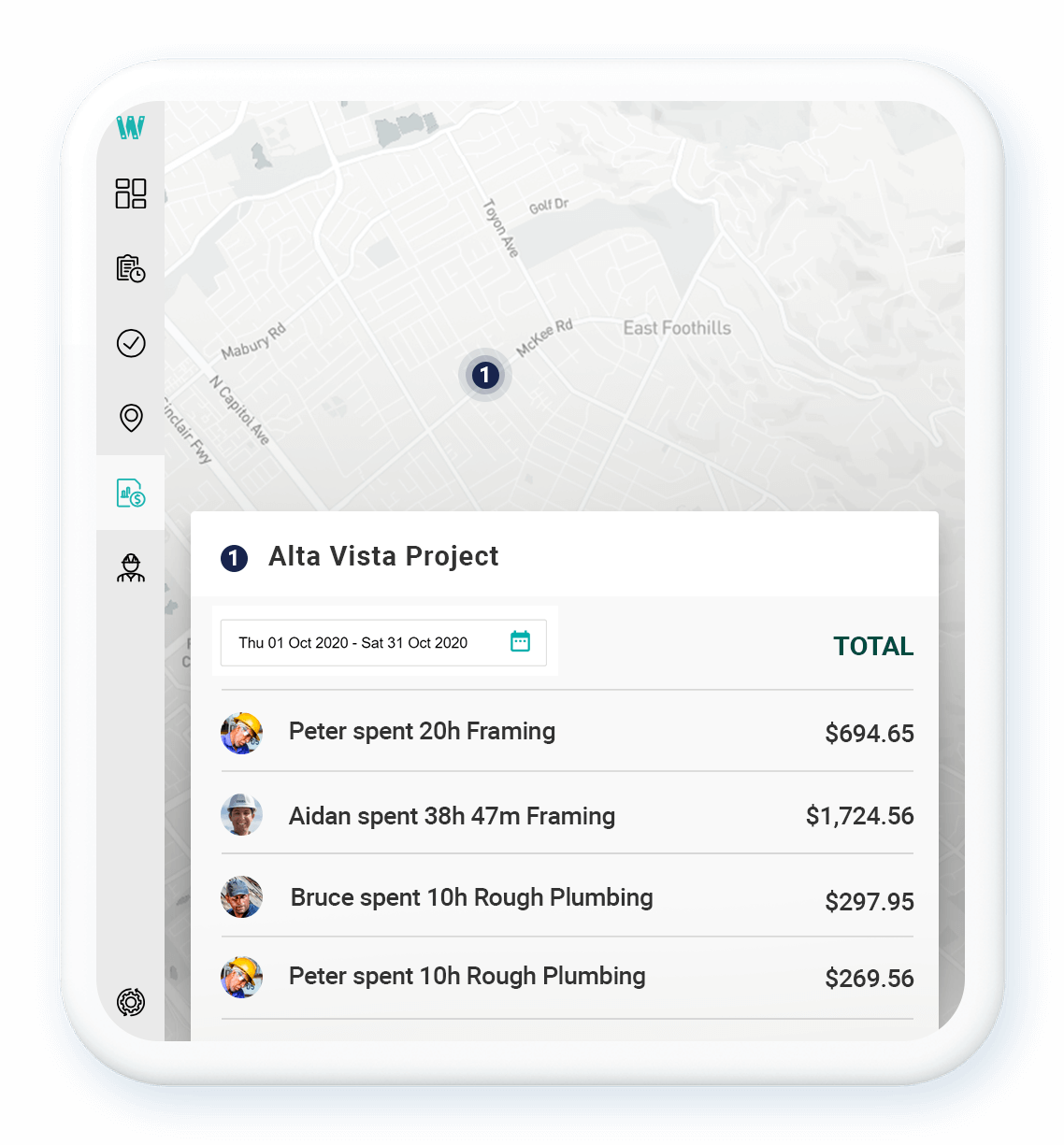

Workyard’s construction job costing software makes it easy for your crew to tag their hours to projects and tasks, providing you with real-time data you need to increase the accuracy of client invoices and improve profitability on every project.

Employee Mileage reimbursement is when employers compensate their employees for using their personal vehicle for work. Often, employers will pay employees a “per mile” rate that covers the cost of gas, maintenance, and other expenses.

When choosing a rate, it’s important that businesses not only follow state and federal laws but also provide a rate that is competitive and fair to employees. After all, no one wants to put wear and tear on their vehicle without being compensated for it.

It’s also crucial that employers provide a rate and mileage tracking process that does not result in over-reimbursing employees. Today, one of the best processes for recording mileage for reimbursement is using GPS time clock apps . Apps like Workyard help simplify mileage reimbursement by allowing employees to quickly enter the reason for their trip and automatically record the starting point, destination, and total miles.

Having your mileage reimbursement form properly filled out helps ensure you are accurately logging mileage and providing the correct reimbursement to employees. When completing a manual mileage reimbursement form, employees must record: Date and Time: By logging the date and time of trips, you will have a record of when employees used their vehicle for business purposes that can be used in the case of an audit.

Travel Locations: This includes the starting location, and destination of travel. This can help clear up any confusion if the total mileage calculation appears off.

Reason for Travel: Employees must record a description of why they were using their vehicle for business purposes. An example of this would be “Drove from head office in Houston to manufacturing facility in Austin for monthly meeting.”

Odometer Reading: Before an employee begins their trip, they must enter their vehicle’s odometer reading. When they arrive at their destination, they will also record the ending reading. These readings help employers calculate the total miles driven for each trip.

Miles Traveled: Here, employees can subtract their ending odometer reading from their starting reading to get the total miles traveled for their trip.

For manual reimbursement forms, the most challenging parts are ensuring they have been fully filled out, have not been misplaced, and meet federal/ state guidelines. Once you have all of the required information, calculating reimbursement is pretty straightforward.

Here is a simple breakdown of how to calculate mileage reimbursement:

First, take the total miles driven and multiply by your mileage reimbursement rate. For this example, we’ll use the 2023 IRS standard mileage rate of 65.5 cents per mile.

If an employee recorded a total of 125 miles driven between job sites in a pay period, the calculation would be:

125 miles x 0.655= $81.88 to be reimbursed.

Federally, there are no laws that declare employers must pay for mileage in the U.S, unless not reimbursing would put an employee’s hourly pay below minimum wage. However, there are a few U.S states that require mileage reimbursement . These include California, Illinois, and Massachusetts.

Although mileage reimbursement may not be required in your state, many businesses still opt for compensating for mileage to maintain competitive wages. This can be done by using the IRS standard mileage rate, or another rate that accounts for all of the costs associated with an employee using their vehicle for work.