This installment of the Beat borrows an idea that showed up recently in a couple of posts on econ twitter (hat-tips to @RobinBrooksIIF and @TheStalwart). Though there are many more moving parts to the economic dynamics than shown in the figures below, they still reveal a clear and important lesson regarding countercyclical economic policy: swift and substantial policy responses to economic shocks make a positive difference to the course of the subsequent recovery. In this case, that difference is measured by how quickly real consumer spending regained its prior trend.

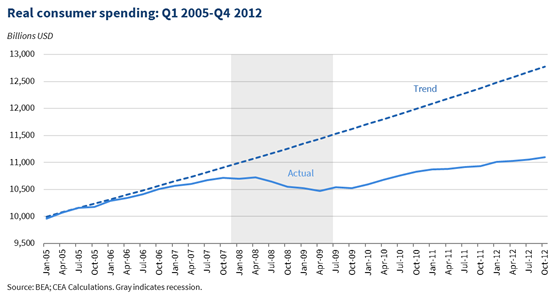

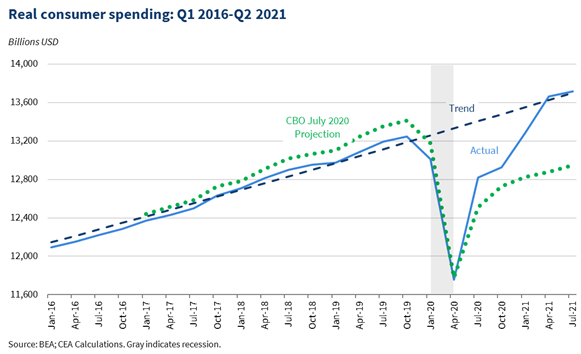

The figures plot real consumer spending against pre-recession trends. In the first figure, covering the recession that followed the bursting of the housing bubble, we see a downshift in trend that persists even as the expansion takes hold. In the second figure, which tracks the pandemic-induced recession, we see real spending quickly climb back to its pre-recession trend.

One reason for this difference is the greater magnitude of fiscal response to the pandemic-induced recession. The second figure provides some evidence for this claim by adding the Congressional Budget Office’s July 2020 forecast of real spending, which did not, of course, include the impact of President Biden’s Rescue Plan that passed in March of 2021. While spending would have partially recovered, it was expected to remain below trend.

As noted, there are many more factors in play here, including the fact that different shocks (e.g., pandemics vs. bursting bubbles) have different macroeconomic impacts. But even so, one lesson from recent economic history is that a quick and fulsome response to a negative shock can hasten the return to the pre-crisis trend.