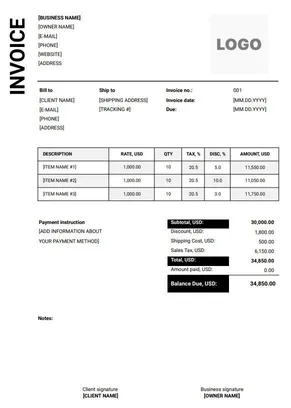

A tax invoice is essentially a standard invoice issued by a seller to a client, encompassing all the essential details found in a regular invoice. The key distinction lies in the inclusion of tax-related information, specifically the tax rate and the taxable amount for the products or services listed. In a tax invoice, the tax rate is expressed in percentage format, and the invoice reflects the applicable tax on the taxable amount. This ensures transparency and compliance with tax regulations, allowing both the seller and the client to track and understand the taxation associated with the transaction.

Let's break it down with an example. Suppose you're operating a tax-registered business and selling a product or service. In such cases, issuing a tax invoice to the client is mandatory. The tax invoice should comprehensively detail the product/service name, its rate, and quantity.

When specifying the rate, it's imperative to include the applicable tax rate. Tax rates can vary based on the country, but for this example, let's assume a tax rate of 10%. Now, if the product's price is $100, the tax amount would be 10% of $100, resulting in an additional $10. Therefore, the total amount per product, inclusive of tax, would be $110 ($100 + $10).

This breakdown ensures clarity for both the seller and the client, providing a transparent account of the product's cost and the associated tax.

You can make a same tax invoice in different ways. Here I will showcase you all the possible and the easiest to hardest method to create a tax invoice template. Mostly you can create tax invoice using templates, tools or can create your own tax invoice template.

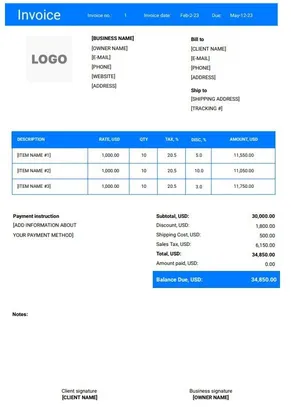

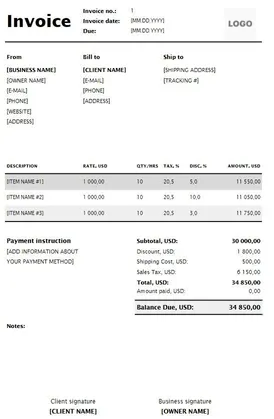

Creating a tax invoice template in Excel provides practical advantages for mathematical calculations and overall ease of use. Here's a more detailed guide on how to create a tax invoice template in Excel:

Open Excel or Google Sheets: Launch the spreadsheet software on your computer.

Choose or Create a New Sheet: Select a suitable template if available or start a new sheet for your tax invoice.

Set Up Headers: Create headers for essential details such as your business name, contact information, client details, invoice number, and date.

Product/Service Information: Add columns for product or service details, including names, descriptions, quantities, rates, and subtotals for each line item.

Tax Calculation: Introduce a specific column for tax calculation. You can use formulas like =Amount * TaxRate to automate this process.

Total Calculation: Include a column to calculate the total amount, incorporating taxes, for each line item and the overall invoice.

Additional Fields: Add any extra fields relevant to your business, such as payment terms, due dates, or additional notes.

Formatting: Ensure the layout is clear, professional, and aligned with your brand. Adjust fonts, colors, and borders as needed.

Formulas and Testing: Ensure that all mathematical formulas are accurate. Test the template by entering sample data to verify calculations.

Save and Reuse: Save the template for future use. Create a duplicate for each new invoice, updating details as necessary.

Creating the template in Excel offers a balance between customization and functionality, making it a practical choice for businesses of various sizes and complexities.

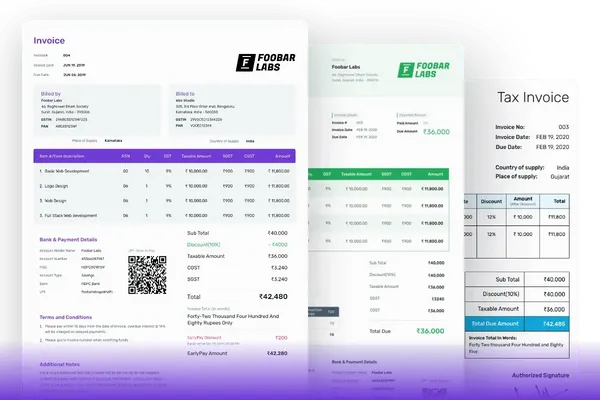

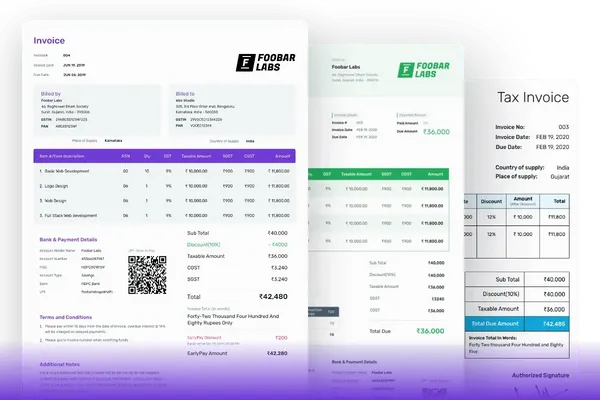

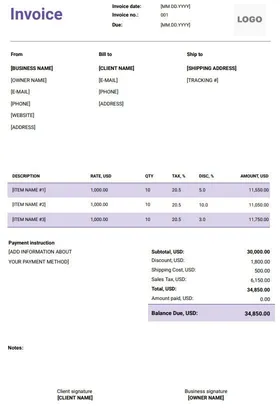

The second method provides a convenient and time-saving option for creating a tax invoice by utilizing downloadable templates. Refrens, for instance, offers a variety of tax invoice templates that cater to the needs of tax-registered businesses. Here's a more detailed guide on using downloadable templates:

Visit Refrens: Navigate to Refrens or a similar platform that provides downloadable tax invoice templates.

Select a Template: Choose a tax invoice template that aligns with your business requirements and preferences.

Download the Template: Download the selected template in Excel, Word, or PDF format, depending on your preference and software compatibility.

Open in Excel or Word: Open the downloaded template in the spreadsheet software of your choice (Excel or Word).

Edit Details: Customize the template by filling in essential details such as your business name, contact information, client details, and specific invoice details.

Save and Convert to PDF: Save the edited template and consider converting it to PDF format for easy sharing and future reference.

Review and Print-Friendly Design: Ensure that the template maintains a simple, print-friendly design. Tax invoices are often preferred in plain black and white, prioritizing clarity over elaborate design.

Use Consistently: Once customized, use the template consistently for your tax invoices, maintaining a uniform and professional appearance.

This method streamlines the process by providing ready-made templates that are both professional and functional. It allows businesses to focus on essential details without the need for extensive customization.

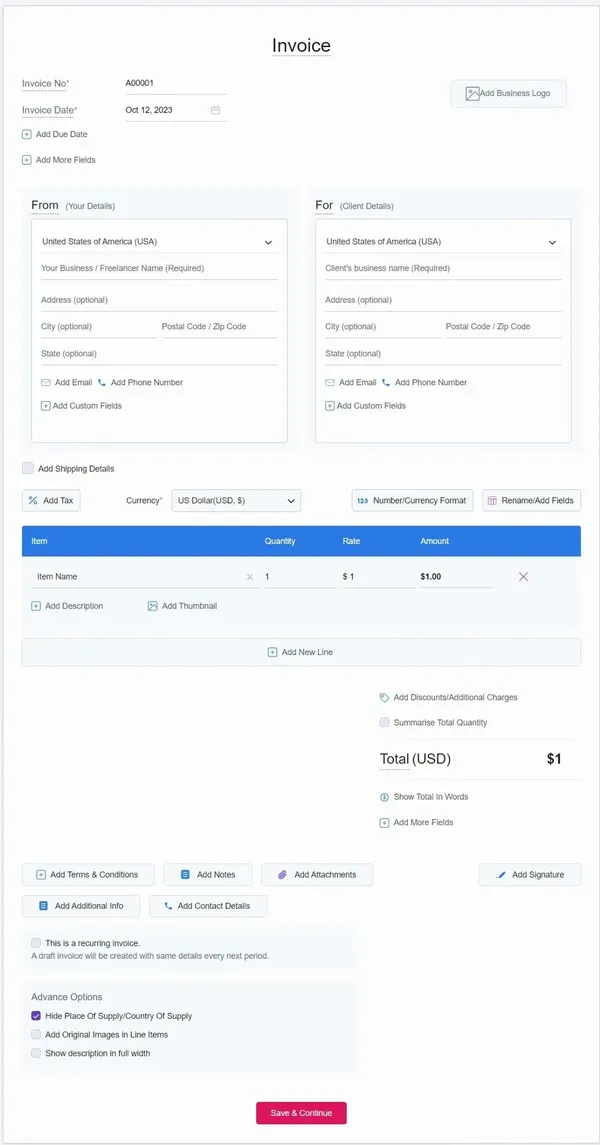

The third and easiest method involves using specialized tools like Refrens' invoice generator or comprehensive invoice software to create tax invoices. Here's a detailed guide on using such tools:

Choose a Reliable Tool: Opt for a trusted and user-friendly tool like Refrens invoice generator or invoice software.

Access the Tool: Visit the Refrens platform or the chosen tool that offers invoice generation and management features.

Sign In or Register: Sign in to your account or register if you are a new user. Ensure you provide accurate business details during the registration process.

Select Tax Invoice: Navigate to the option for creating a tax invoice within the tool. Choose the tax invoice template that suits your business needs.

Fill in Details: Input essential details such as your business name, contact information, client details, product or service details, tax rate, and any applicable discounts.

Review and Edit: Review the generated tax invoice and make any necessary edits to ensure accuracy and completeness.

Save and Share: Save the completed tax invoice within the tool and choose your preferred method of sharing, whether through email, download as PDF, or other options provided.

Explore Additional Features: Take advantage of additional features offered by the tool, such as creating quotations, proforma invoices, purchase orders, managing clients, and tracking inventory.

Effortless Management: Enjoy the convenience of an all-in-one solution for managing your business transactions, reducing the manual effort required for invoicing and related tasks.

Utilizing an invoice generator or software simplifies the invoicing process, allowing you to create professional tax invoices efficiently while also streamlining other aspects of business management.