Deferred compensation is a financial arrangement where employees can elect to receive a portion of their income at a later date, typically during retirement. This provides individuals with a means to save for the future in a tax-advantaged manner.

Employees agree with their employer to defer a portion of their salary or bonuses. This agreement outlines the terms and conditions of the deferred comp plan.

The deferred amount is deducted from the employee’s salary before taxes are calculated. This means that the deferred income is not subject to federal income tax, providing an immediate tax benefit to the participant. In some cases, state income tax may still apply.

Options may include mutual funds, stocks, bonds, or other investment vehicles. The goal is to allow the deferred funds to grow over time, potentially maximizing returns.

The employee’s contributions and any earnings on those contributions are not taxed until withdrawal. This allows the investments to compound over time without immediate tax implications.

Employees who leave the company before the vesting period is complete may forfeit some or all of the employer-contributed funds.

When the employee reaches a specified triggering event, such as retirement, reaching a certain age, or leaving the employer, they can begin receiving distributions from their deferred comp account. The distributions can be taken as a lump sum, periodic payments, or other agreed-upon methods.

Withdrawals from deferred comp plans before reaching the specified triggering event may result in penalties. Early withdrawals could incur taxes and penalties, discouraging employees from accessing the funds before they are intended for retirement.

Deferred compensation plans are subject to various regulations, including those outlined in the Internal Revenue Code (IRC). Different sections of the IRC, such as Section 457 for government and non-profit employees, govern these plans’ specific rules and tax implications.

Overall, deferred compensation provides a structured and tax-advantaged way for individuals to save for their future needs, especially in retirement. When participating in such programs, employees must carefully review the terms of their deferred compensation plan, understand the investment options, and consider their long-term financial goals.

A considerable driver of adoption is deferring taxes on income until it is received. This can result in significant tax savings if you are in a higher tax bracket during your working years.

Contributing to a deferred compensation plan can supplement your other retirement savings and create a more secure financial future—particularly if you do not have access to traditional retirement plans or are dealing with complex financial matters such as overseas compensation or real estate acquisitions.

Since deferred compensation is non-qualified savings, meaning the account’s value is at risk of loss if the company falls into financial trouble, it’s generally recommended to take advantage of this opportunity closer to retirement. Maximizing your deferral opportunity five or so years out from retirement and drawing from after-tax savings to supplement your lifestyle, if needed, can significantly reduce your effective tax rate in the final working years of your career.

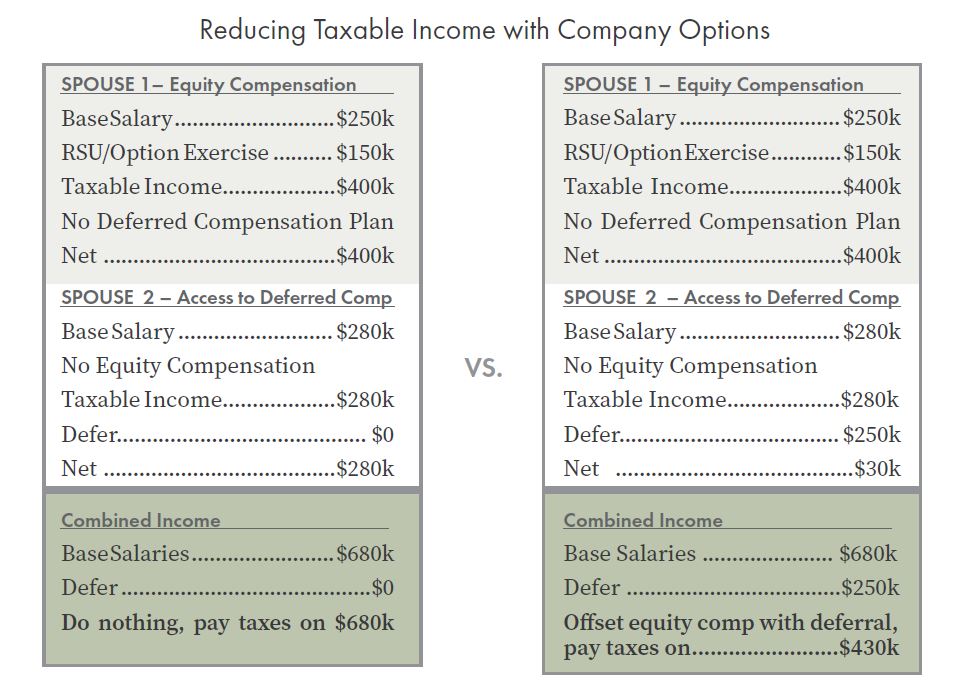

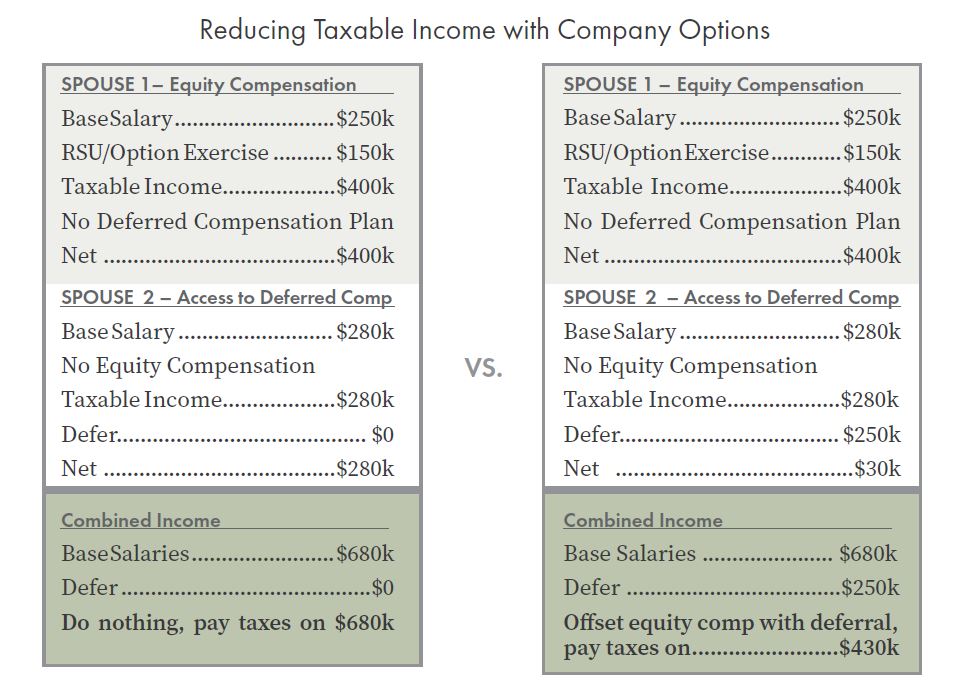

Below is an example of how someone can reduce their taxable income by the amount of income they anticipate receiving in exercised stock option proceeds. If they had done nothing, they would have picked up their base salaries and the income associated with the option exercise and, in so doing, paid taxes on an additional $250k of income that year.

While different options offer tax advantages and the opportunity to save for retirement, key differences may make specific options better for your financial goals.

Take contribution limits. A 401(k) plan has a maximum contribution limit determined by the IRS: deferred compensation plans often have higher contribution limits, allowing you to set aside a more significant portion of your income for retirement.

Your circumstances and objectives will influence your choice of retirement plan.

If you anticipate needing access to your retirement funds before reaching the age of 59 ½, a 401(k) plan may offer more flexibility.

A deferred compensation plan may be a better fit if you can contribute a larger portion of your income and prefer the potential for higher tax-deferred growth.

Understanding the tax considerations associated with deferred comp is essential for making informed decisions. Here are some key points to consider:

Working with a qualified financial advisor or tax professional can help ensure compliance with these regulations and maximize the tax advantages of deferred compensation.

I work as my client’s Personal CFO to help them understand their current and future financial situation so that they can gain comfort in knowing that they will be able to live and experience life the way they want.

Reach out to learn more about how our comprehensive approach to wealth management can help you achieve your goals.